Article by Fidinam

Tax Liabilities for Foreign Employees in Vietnam

Foreigners working in Vietnam are required to pay personal income tax (PIT) in accordance with Vietnamese law. The tax rate and the range of taxable income will depend on whether the person is considered a resident or non-resident in Vietnam during the fiscal year.

Accordingly, those individuals meeting one of the following criteria are residents of Vietnam:

(1) Residing in Vietnam at least or for more than 183 days in a calendar year or within twelve (12) consecutive months since the date of arrival.

(2) Having a regular residential location in Vietnam, including:

i. Having a Temporary Residence Card or Permanent Residence Card.

ii. Having a leased house with a term of 183 days mor more.

In case the taxpayer satisfies either condition of having a regular residential location as mentioned in point (2) above but stay in Vietnam less than 183 days in a tax year, he/she might be considered as non-resident however provided that she/he needs to provide a Certificate of Residence issued by the competent authority of a foreign country confirming that he/she was the resident of that country in the concerned tax year.

Individuals not meeting any of the above-mentioned criteria are non-residents.

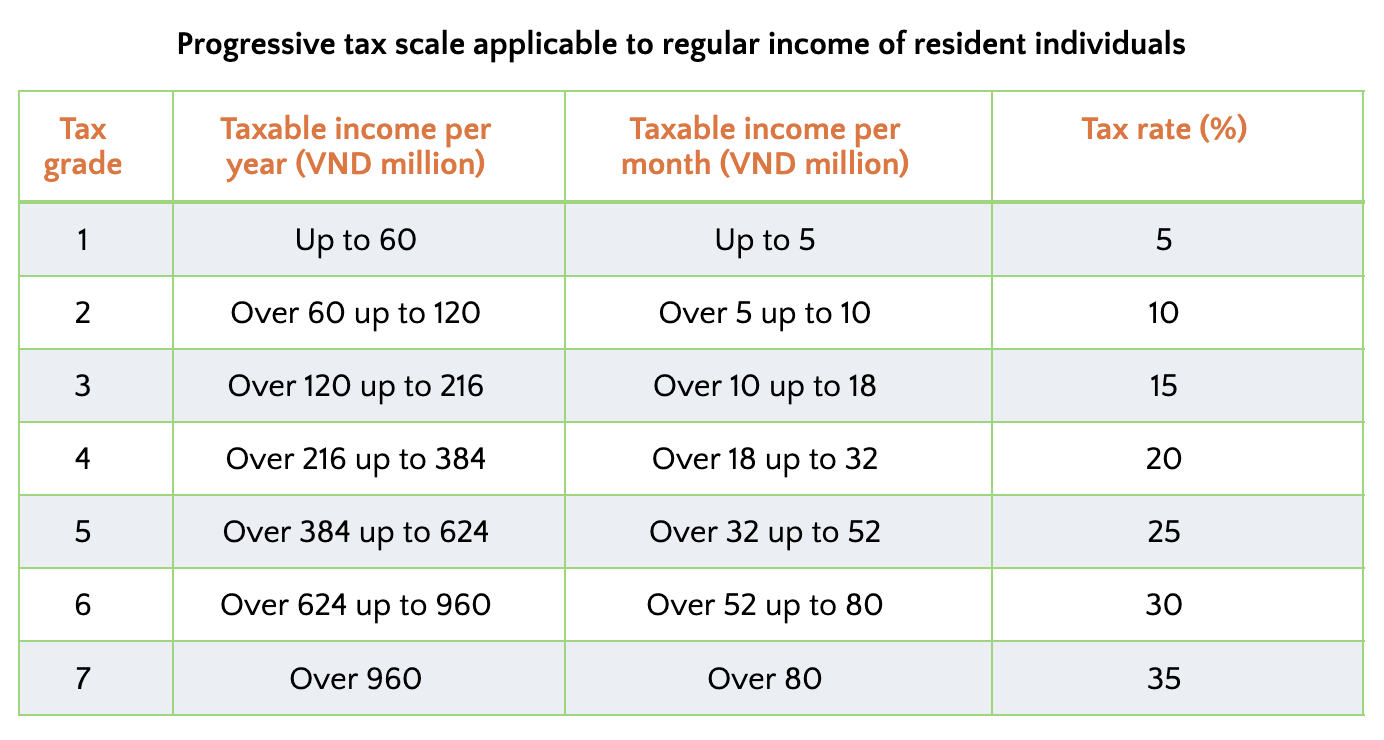

Regardless of the place of payment, foreign employees who are Vietnamese tax resident pay PIT on employment income on progressive rates while non-residents are subject to PIT at a flat tax rate of 20% on the income earned from working in Vietnam/on Vietnam-related income in the tax year.

Resident individuals are entitled to make tax finalization at the end of the year, and may be refunded if they have overpaid, or must pay additional amounts if they have underpaid.

In terms of PIT declaration and payment procedures, enterprises in Vietnam paying income are responsible for withholding and paying taxes on behalf of foreign workers at the time of salary payment. As for the tax finalization, if the foreign employees have only one employment sourced income paid by the company, the company shall carry out the PIT finalization on their behalf.

For more information, visit Fidinam at https://www.fidinam.com/en/vietnam